The commissioner argued that even if there was no reliance on the tax opinions, putting the taxpayers’ state of mind in issue waived privilege because the content of the opinions was relevant to the taxpayers’ state of mind.

They specifically disclaimed reliance on outside counsel’s opinions. However, in this case, although the tax opinions were received before the tax returns were filed, the taxpayers asserted that they had made their own independent analysis of the transactions. In such cases, the law is clear that assertion of these defenses waives privilege with respect to the tax opinion. Typically, taxpayers that assert reasonable belief or reasonable cause defenses rely, at least in part, on tax opinions they have received from outside tax advisers. In defense to all three of the asserted accuracy-related penalties, the taxpayers also relied on the “reasonable cause†exception under which a penalty would not be imposed if an underpayment were due to reasonable cause and the taxpayer acted in good faith.

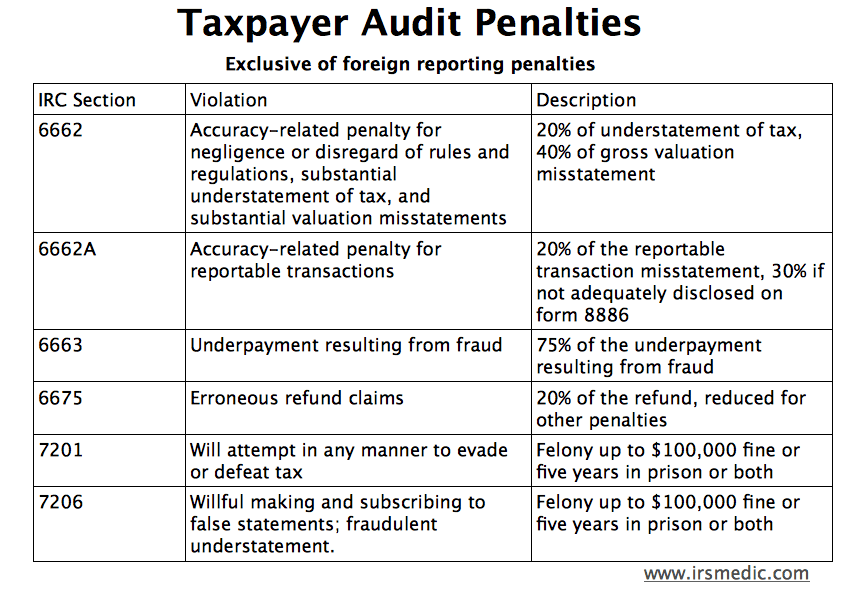

#IRC 6662A CODE#

Specifically, in defense to the assertion of a substantial understatement penalty, the noncorporate taxpayers contended that even assuming that the transaction was a “tax shelter†as defined in Internal Revenue Code (IRC) section 6662(d)(2)(C), (1) there was substantial authority for their position and (2) the taxpayers “reasonably believed†that the tax treatment was more likely than not correct. But the IRS contended that the taxpayers had waived privilege by asserting affirmative defenses based on the taxpayers’ belief or state of mind. The IRS did not contest that the opinions were privileged communications. The taxpayers argued that the letters were privileged attorney-client communications. The issue addressed by the Tax Court was whether the taxpayers were required to turn over six opinion letters received from their outside tax advisor. The taxpayers are contesting the substantive tax adjustments and the penalty determinations. In addition to challenging the tax treatment of the underlying transactions, the IRS asserted penalties attributable to: (1) substantial understatement of income tax (2) gross valuation misstatement and (3) negligence or disregard of rules and regulations. Son of Boss transactions are Internal Revenue Service (IRS) listed transactions that have been the subject of widespread litigation and a nationwide IRS settlement program. Tax Court extended the implied waiver doctrine to apply when a taxpayer asserts a penalty defense based on the taxpayer’s belief or state of mind, even if the taxpayer explicitly disclaims reliance on the opinion.ĪD Investment 2000 Fund LLC (AD Investment) involved consolidated partnership-level proceedings for tax year 2000 with respect to Son of Boss transactions.

It is well established that there is an implied waiver of the attorney-client privilege with respect to a tax opinion letter if the taxpayer relies on the opinion letter in defense of an asserted tax penalty. Commissioner that a taxpayer’s assertion of a state of mind penalty defense waives the attorney-client privilege with respect to tax opinions provided to the taxpayer in advance of filing the taxpayer return, even if the taxpayer explicitly disclaims reliance on the tax opinions. Tax Court concludes in AD Investment 2000 Fund LLC v.

0 kommentar(er)

0 kommentar(er)